In the fast-paced world of startup funding, one method has become increasingly popular for early-stage companies looking to raise capital quickly — convertible notes.

Convertible notes let you secure funding without spending months negotiating your company's valuation. These short-term debt instruments give founders a flexible way to get money in the bank now, with the equity conversion happening later when you have more traction and data.

While this guide focuses on convertible notes, many startups also consider SAFEs as an alternative. Learn more about SAFEs here.

This comprehensive guide breaks down everything you need to know about convertible notes: how they work, why they're useful, and how to actually use them. Let's get started!

Convertible notes, explained

What is a convertible note?

Convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure financing during their early stages. They represent a loan that can be converted into equity at a later stage, usually during a subsequent financing round or an exit event.

Investors lend money to startups with the expectation that it will be repaid or converted into ownership in the company.

How convertible notes work?

When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the terms of the investment. The note typically includes details such as the principal amount, interest rate, maturity date, conversion terms, and other relevant provisions.

The key aspect of a convertible note, as the term implies, is its conversion feature. Instead of receiving immediate equity, the investor has the option to convert the loan into shares of the startup at a later date, usually when specific conditions are met, such as a subsequent funding round or an acquisition.

Let's break that down:

- An investor lends money to a startup in exchange for a convertible note. This is a convertible debt that the startup agrees to repay, usually within 2-5 years.

- Before the note comes due, the investor has the option to convert the debt into equity shares in the company, like stock. This typically happens when the startup raises a bigger round of funding or has an initial public offering (IPO).

- If the investor converts the debt, they essentially trade in the money owed to them for shares in the company. The conversion terms are outlined in the note and usually give the note holder equity with a discount rate.

- If the note is not converted, the startup has to repay the investor the full amount of the note plus any interest.

Benefits of using convertible notes

The big advantage with this form of raising is that you don’t really need to know what your company is worth to get the funds in your account – you simply agree that when your company does eventually do a raise and your equity is valued, the lender (investor) will be provided shares at that value based on the funds provided (with any discount rate that might be agreed).

This keeps everyone happy! The investor can be rewarded for taking the risk in investing early, by getting the opportunity for discounted shares, or at worst, getting their money back with interest; and the company gets money in the bank, can extend its runway, and be in a stronger position to raise more funds once everything is more certain. Let's break that down:

For investors

- Flexible terms. Convertible notes offer flexible terms for both the investor and the startup founder. The terms of the note can be negotiated to meet the needs of both parties.

- Lower valuation risk. By using a convertible note, investors can avoid the risk of valuing the startup too early. The valuation of the company can be determined at a later date when more information is available.

- Delayed dilution. By using a convertible note, investors can delay the dilution of their equity until a later date when the company has a higher valuation.

For startups

- Access to funds, fast. Convertible notes are often easier to obtain than equity funding. This is because the terms of the note are generally less complicated than traditional equity financing.

- Lower legal fees. Because convertible notes are less complicated than equity funding rounds, the legal fees associated with them are typically lower.

- Delayed valuation. By using a convertible note, early stage startup founders can delay the valuation of their company until a later date when the company has a higher valuation.

Not sure if convertible notes are right for your raise? Compare convertible notes vs SAFEs to find the best fit for your ew

Convertible note examples

We have had first hand experience of the benefits of raising through convertible notes here at Cake – so we can really vouch for the springboard they provide.

A Convertible Note worked well for Cake as we were able to obtain early funding which allowed us to build and grow, while avoiding the delays and complications of a valuation. It still offered a financial return to investors via the 30% discount to the priced round. With the Convertible Note funding we progressed the company to achieve milestones that allowed a priced equity Seed Round.

—Jason Atkins, President & CEO of Cake Equity

Here are a few more examples of well-known companies that used convertible notes in their early stages:

Airbnb

The popular short-term rental startup Airbnb raised $600,000 in 2009 through a convertible note from Y Combinator and Sequoia Capital. The note converted to equity with a 20% discount during Airbnb’s $7.2 million Series A round led by Greylock Partners about a year later.

Dropbox

Dropbox, the file hosting service, raised $1.2 million in 2007 through a convertible note from Sequoia Capital. When Dropbox raised its $7.2 million Series A round in 2008, Sequoia's note converted into equity at a 20% discount. Dropbox’s valuation at the time of the Series A was just $46 million—today the company is valued at over $10 billion!

Uber

In its early days, ride-hailing giant Uber raised $1.6 million through a convertible note in 2010. The note, led by First Round Capital and Lowercase Capital, converted into equity during Uber's subsequent funding rounds. This strategic move allowed Uber to expand rapidly and revolutionize the transportation industry.

Key terms in a convertible note agreement

Before using convertible notes, you need to understand some of its key features:

Conversion discount

The conversion discount refers to the discounted price at which convertible note holders can convert their notes to equity shares. Usually around 15-25% off the price of shares in the next funding round. The bigger the discount, the better for investors.

Valuation cap

The valuation cap puts an upper limit on the valuation used to determine the conversion price for the notes. Valuation cap protects note holders by ensuring they get equity shares at a price that values the company at no more than the cap amount. The lower the valuation cap, the more shares you can get.

Interest rate

The interest rate is the percentage charged for borrowing money, like on a loan. With convertible notes, the interest rate is often low, around 5-8% per year. The startup issuing the note will pay note holders this interest on the principal amount.

Maturity date

The maturity date is when the convertible note debt comes due. On this date, either the note converts to equity shares or the startup repays the principal plus any accrued interest.

Conversion price

The conversion price is the price per share you pay to convert your convertible notes into equity shares. It’s equal to the lesser of the next funding round’s price per share minus the conversion discount OR the valuation cap divided by the number of shares outstanding.

Next equity financing round

The next equity financing round refers to the startup’s next sale of preferred stock to raise funds. The terms of this round determine the conversion price for any convertible notes.

Understanding these key terms and their implications on your potential investment in a startup’s convertible note is critical. Don’t hesitate to ask questions to make sure you have a firm grasp of how the note’s provisions may affect you before providing funding.

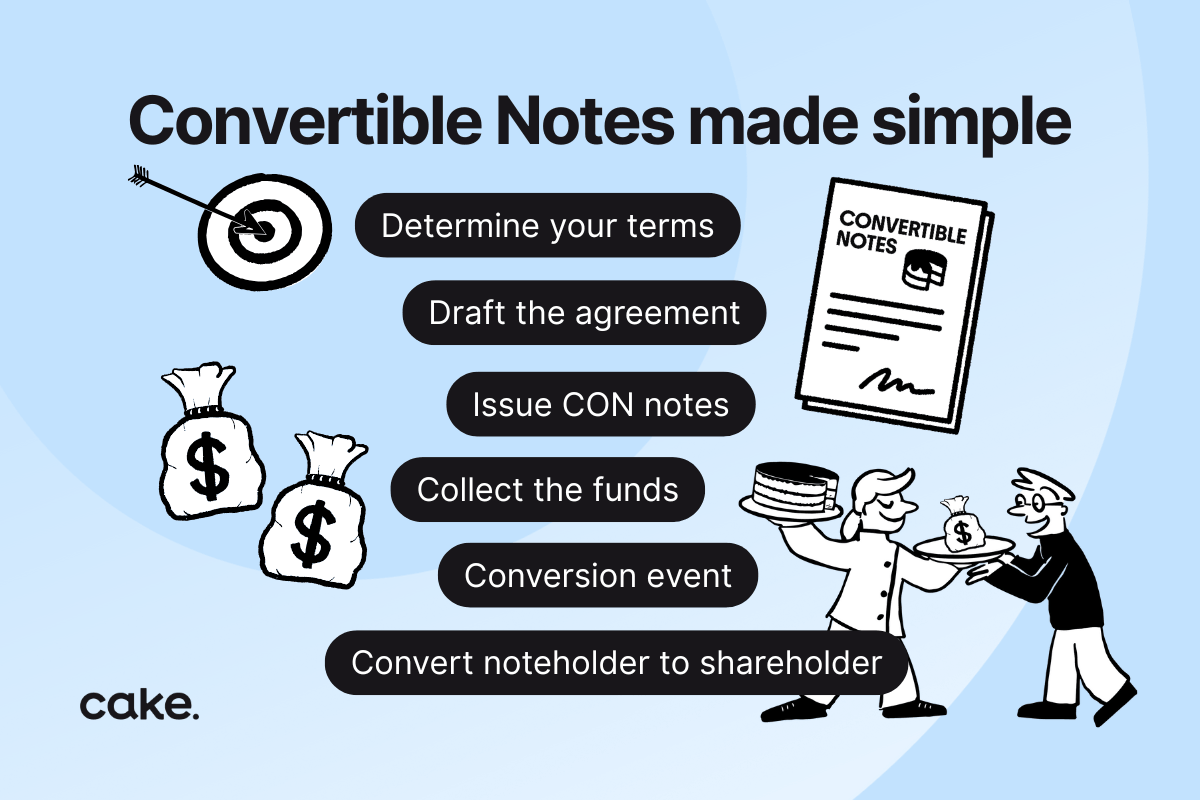

How to issue convertible note agreement?

Issuing convertible notes involves several steps. Here's a general guide on how to issue convertible notes:

1. Determine the terms

Decide on the key terms of the convertible note, as listed above. Conversion discount and price, valuation cap, interest rate, maturity date, and any other relevant provisions. Consult legal and financial professionals to ensure compliance with applicable laws and regulations.

2. Prepare the convertible note agreement

Draft a comprehensive legal document outlining the terms and conditions of the convertible note. This agreement should cover the rights and obligations of both the issuer (your company) and the investor.

Cake has a convertible note template that's free to use with our equity management software. Approved by lawyers and used by many startup founders. Check it out.

3. Execute the convertible note agreement

Before issuing the convertible notes, conduct due diligence on the investor(s). This may involve verifying their accreditation status, conducting background checks, and reviewing their financial capabilities.

Once the convertible note agreement is finalized, both parties (your company and the investor) should sign it. Ensure that all necessary parties sign the agreement, and keep copies of the executed document for record-keeping purposes.

4. Collect the funds

After executing the agreement, the investor will transfer the agreed-upon funds to your company. Ensure that you have a secure and traceable method for receiving the investment amount and documenting the transaction.

5. Documentation & communication

As you work towards your company goals, make sure that you maintain accurate records of the convertible notes, including interest accrued and conversion terms. Use a reliable accounting system or software to track these details.

Keep the investor informed about the progress of your business. This may include sharing financial statements, operational updates, and any significant events that may impact the conversion terms or the investor's investment.

6. Conversion or repayment

As the maturity date approaches, the convertible note will either convert into equity based on the predetermined conversion terms or be repaid to the investor with the agreed-upon interest. Ensure you follow the terms outlined in the convertible note agreement.

It's crucial to note that issuing convertible notes can be a complex process, and the specific steps may vary depending on the jurisdiction and the legal requirements applicable to your business. Seeking professional advice from legal and financial experts is highly recommended to ensure compliance and mitigate potential risks.

Fast and simple convertible notes with Cake

At Cake, we know that issuing convertible notes involves multiple moving parts that can overwhelm early-stage startups. Our platform simplifies the entire process:

- Lawyer-approved templates. Launch your raise in minutes with built-in, customizable agreement templates.

- Automated tracking. Monitor all notes in one centralized Registry with automatic alerts for maturity dates and conversion events.

- Seamless cap table integration. View fully diluted shares instantly and see how conversions impact your ownership structure.

- Built-in investor transparency. Give note holders direct access to track their investments without extra communication overhead.

From setup to conversion, Cake handles the complexity so you can focus on building your business.

When to use convertible notes?

Convertible notes aren't the right choice for every funding scenario. Understanding when they make the most sense can help you choose the best financing strategy for your startup's current stage and goals.

Ideal scenarios for convertible notes

Early-stage funding (Pre-seed and Seed)

Convertible notes shine brightest when your startup needs capital but lacks the traction to confidently set a valuation. If you're pre-revenue or just starting to gain users, it's difficult to justify a specific company valuation to investors. Convertible notes let you defer that conversation until you have more proof points that support a higher valuation—revenue growth, user adoption, product-market fit.

Bridge financing between rounds

Sometimes you need additional capital to reach the milestones that will unlock your next major funding round. Rather than raising a full Series A when you're 80% of the way there, a convertible note can extend your runway by 6-12 months. This "bridge round" keeps you moving forward without the complexity and time investment of a priced equity round.

When speed matters

Traditional equity rounds can take 3-6 months to close when you factor in term sheet negotiations, due diligence, legal documentation, and investor coordination. Convertible notes can close in 2-4 weeks. If you need capital quickly to seize a market opportunity, prevent running out of cash, or onboard a key hire, convertible notes offer the speed you need.

Smaller funding amounts

For raises under $2 million, the legal complexity and costs of a full priced round often don't make sense. Convertible notes have simpler documentation and lower legal fees, making them more economical for smaller amounts. Why spend $30K-$50K in legal fees for a $500K raise when a convertible note can accomplish the same goal for a fraction of the cost?

Valuation disagreements

When you and potential investors see your company's worth differently, convertible notes offer a middle ground. Instead of walking away from funding or accepting unfavorable terms, you can agree to convert at the next priced round when the market validates your company's value with fresh investor money.

When to consider alternatives

Convertible notes might not be the best choice if you're:

- Raising a large Series A or later round (typically $3M+)

- Already have a clear, defensible valuation

- Want to establish formal board structure and governance

- In a strong negotiating position with multiple term sheets

For these scenarios, a priced equity round or SAFE note might serve you better. Compare convertible notes vs SAFEs to explore your options.

The key is matching your financing instrument to your startup's current reality. Convertible notes work best when you need capital now but will be in a stronger position to set terms later.

Quick-fire Q&A

FAQs about convertible notes

Once you issue convertible notes, you’re likely to have questions about how they work. Here are some of the most frequently asked questions about convertible notes:

When do convertible notes convert into equity?

Convertible notes typically convert into equity when your startup raises its next round of funding, like a Series A. The notes convert at a discount to the Series A price per share. For example, if your Series A values the company at $10 million and issues shares at $1 each, holders of convertible notes may get shares at $0.80 each.

Do convertible notes accrue interest?

Most convertible notes do accrue simple interest, often between 5 to 8% per year. The interest is usually paid at conversion. Some notes require interest payments before conversion. The interest rate and payment terms are negotiated between the startup and note holder.

What happens if the notes don’t convert?

If your startup is unable to raise a round before the maturity date of the convertible notes, the notes typically become due and payable. You’ll have to repay the principal plus any accrued interest to the noteholders. This scenario is known as a "maturity default." To avoid defaulting, startups often extend the maturity date to give them more time to raise.

Can convertible notes be converted before the next funding round?

Yes, convertible notes usually contain provisions allowing early conversion at the option of the note holders or the startup. The conversion terms, like the discount rate and valuation cap, are the same as if the notes converted at the next equity round. Allowing early conversion gives note holders more flexibility and the startup more control over its capital structure.

Do convertible notes have voting rights?

Convertible note holders typically do not have voting rights before the notes convert into equity. Once converted, the new equity shareholders (the former note holders) gain voting rights in the startup. The lack of voting rights is one reason why convertible notes are considered "bridge financing." The notes bridge the gap between seed funding and a Series A round that establishes equity ownership and more formal governance.

Hope this helps clarify some of the most common questions about how convertible notes work! Let me know if you have any other questions.

This article is designed and intended to provide general information in summary form on general topics. The material may not apply to all jurisdictions. The contents do not constitute legal, financial or tax advice. The contents is not intended to be a substitute for such advice and should not be relied upon as such. If you would like to chat with a lawyer, please get in touch and we can introduce you to one of our very friendly legal partners.